SaaS Financial Model 1.0

A few years ago, I built one of the most widely-used SaaS Financial Model templates. It was a popular resource among founders, CEOs, and startup finance leaders, and it has maintained a #1 rank on Google for years. I'm always thrilled when people tell me that they've built their own models on top of my template. Skip right to the model here.

I lost the original model with the sale of my previous company, but it provided me with an opportunity to rethink and build it from scratch. Truth be told, the old model was long overdue for a major update. Even the most recent version from 2020 was based on logic I had developed years earlier and badly needed an overhaul.

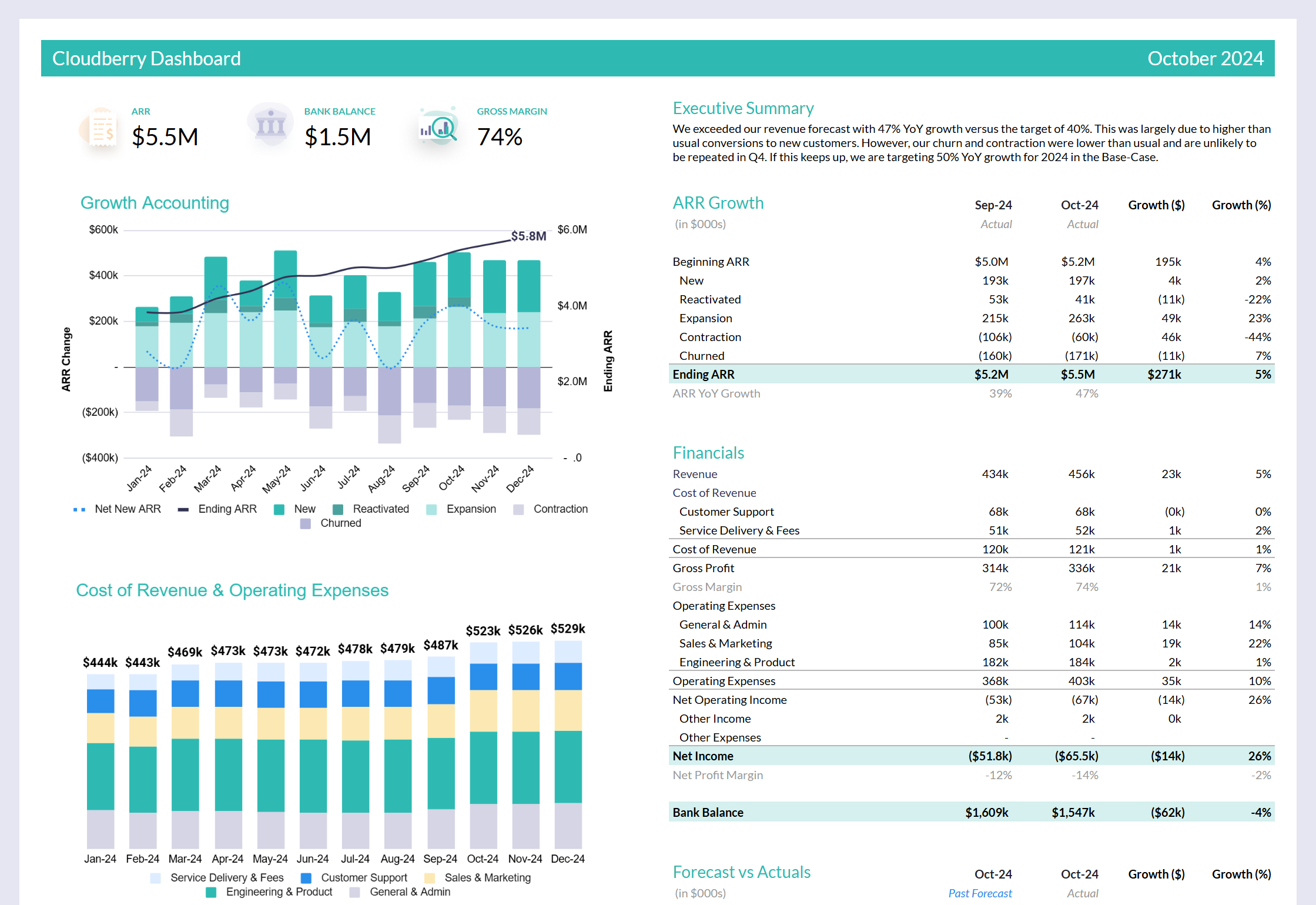

This post features a new-and-improved model I have been using on my fractional CFO work to fund my new startup. The model’s example company is at around $5M ARR with 50% year-over-year growth, and just like many of us now, is switching their focus to cash flow efficiency.

I had a few requirements in mind while building this model. It needed to be:

- Easier to use so I could onboard new clients quickly and efficiently

- Support QuickBooks classes to avoid major changes in my clients' books

- Include new, powerful features like vendor-level forecasting

If you’re looking to build a robust financial model that’s quick to update yet designed to scale with you, this template is for you. Or if you prefer a software approach, check out our Financial Modeling Software Cloudberry.

Why Do I Need a Financial Model?

"A robust financial model was key to our success," said no founder ever.

Throughout my career, I’ve worked with numerous founders, CEOs, and startup leaders, advising them on financial modeling. Not a single one of these leaders attribute their company’s success to a financial model. Instead, you hear the usual suspects of an amazing team, stellar product, right market, and even luck.

Yet, many of these founders would readily admit that without an operationally focused financial model, their companies could have been in dire financial straits. By “operationally focused”, I mean a financial model that’s actively used for decision-making—not the one you build while fundraising and never update again.

I find it easier to understand the importance of an operational financial model by considering what can go wrong without one.

What if you miss your Q1 revenue goals but continue hiring as planned? Without a tool to forecast with, how will you know if you can catch up in Q2, or if you’re heading toward a cash crunch? Should you delay planned hires? What if these hires are the salespeople you need to hit this year’s targets?

This isn’t hyperbole. I once worked with a client who was riding massive growth. Think over 3x year-over-year, with revenue already in the millions. Confident this would continue, they took out a sizable loan to fuel expansion. But growth unexpectedly tapered off, and they faced what seemed like an inevitable cash crunch.

Fortunately, we had a financial model in place, and the monthly updates with the founders provided a tight feedback loop. By frequently comparing actuals to previous forecasts and adjusting for new information on growth, the founders gained a clear view of their financial situation and realized they had fallen squarely into their worst-case scenario.

Armed with this admittedly depressing insight, they quickly identified the levers to pull: implementing a hiring freeze, temporarily lowering founders' salaries, estimating when the team’s natural attrition would reduce costs, and carefully sizing an additional loan to bridge the cash flow gap until the large renewals were set to come in and save the day.

Though they didn't recapture their rapid growth, the company pivoted from a cash-burning startup to a profitable business, paid back their loans, and allowed the founders to take substantial salaries while focusing on sustainable growth.

How to Get Started

- Navigate to SaaS Financial Model 1.0 Google Sheets Template

- Make a copy of the template

- Clear out the Export and Headcount tabs and start building

Step 1: Build Your Financial Statements

First, build your company’s financial statements—Profit and Loss, Balance Sheet, and Cash Flow Statements.

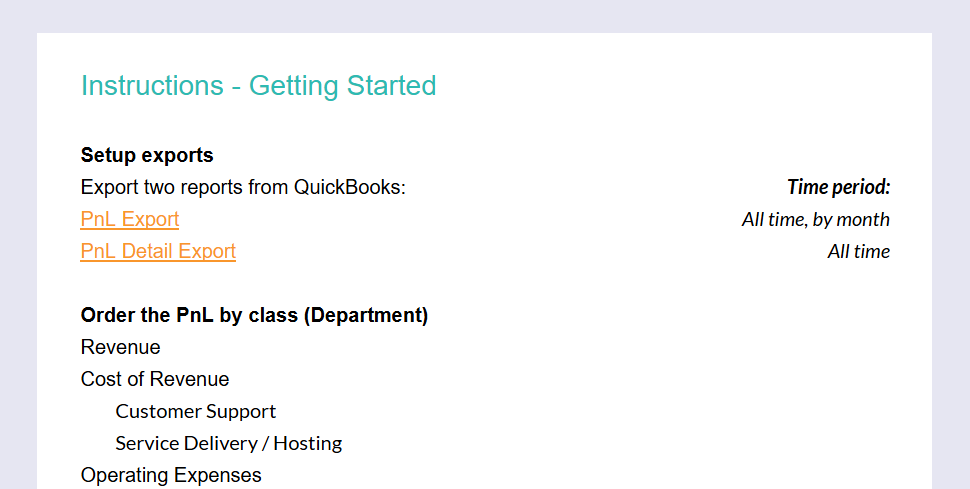

I'm a big proponent of utilizing QuickBooks exports to update your model. Too many times I've seen founders fill in their actuals manually, but what's worse is that these numbers don't even match their accounting. What kind of "actuals" are we even talking about? Made-up kind?

Use the in-template instructions at the bottom of the PnL worksheet to get started with building your financial statements.

Step 2: Build Your Forecasts

Second, start building forecasts. I recommend starting with forecasting revenue on the Revenue tab, followed by Headcount. This makes it easier to finish building the forecasts directly on the PnL, as some of them are a function of revenue or salaries.

Lastly, you can build the remaining forecasts, such as Deferred Revenue, on separate tabs that feed back into the Balance Sheet.

Once you’re done with each section, navigate back to the PnL and pull the forecast values into the PnL using =PULL_DATA formula.

Step 3: Finalize Reporting

After assembling your actuals and forecasts, it’s essential to have a clear, accessible way to review summaries of your projections. I’ve included several pre-built reports, but be sure to verify that each one accurately pulls in the data you just organized.

For example, a pre-built table might include General & Admin, Product & Engineering, and Sales & Marketing expenses. If you want to separate Sales & Marketing or add a Customer Success department, you’ll need to customize the reports using the =PULL_DATA formula and Data Feed columns to achieve that level of detail.

Takeaway

The people most successful with this model spend time upfront getting the foundation in place, enabling them to run quick and easy model updates each month. I’ll be providing more resources for building and updating the model, but in the meantime, feel free to reach out on LinkedIn with any questions.

A financial model helps you plan more effectively, navigate changes strategically, and help you know what levers to pull when you’re heading towards a worst-case scenario - or a best case! It’s like using Google Maps for your commute: you know the route you want to take, but when traffic or roadblocks appear, you want to quickly find the best alternatives to get where you need to go.

Bio

Jaakko Piipponen is the co-founder and CEO of Cloudberry, offering financial modeling software and fractional CFO services. He’s a serial entrepreneur, and has created one of the world's most popular financial modeling templates for SaaS companies.